Become a member

Become a member of the largest creditors' association in Switzerland.

Become a member nowAls Ihr regionaler Partner für den Kanton Zürich unterstützen wir Sie mit Bonitätsauskünften zur aktiven Vermeidung von Forderungsausfällen, das Inkasso sowie die Realisierung von Verlustscheinen.

Das Inkasso der Creditreform Egeli Gesellschaften hilft Ihnen, Ihre Forderungen schneller zu realisieren. Dadurch, dass Ihre Kunden früher zahlen, stärken Sie Ihre Liquidität und vermeiden Verluste. Die Übergabe Ihrer Forderungen an uns und der Negativeintrag in die Creditreform-Bonitätsdatenbank ist eine Konsequenz, die beim säumigen Zahler Wirkung zeigt. Unsere freundlichen, aber bestimmten Inkassospezialisten sorgen dafür, dass Ihre Kunden bezahlen, aber auch Kunden bleiben.

Sie möchten wissen, wie es um Ihre Forderungen steht und was wir bereits unternommen haben? Mit WebINKASSO haben Sie Ihre Inkasso- und Verlustscheinfälle jederzeit voll im Griff. Die aktuellsten Daten sowie ein umfassendes Reporting stehen ihnen jederzeit mehrsprachig zur Verfügung. Neue Fälle übergeben Sie einfach und sicher dank verschlüsselter Kommunikation.

Sämtliche Neuigkeiten, Sachstände und Zahlungen sind übersichtlich für Sie ersichtlich. Direktzahlungen melden Sie uns über WebINKASSO unkompliziert und schnell. Relevante Daten für Ihre Unterlagen stehen Ihnen zum Download zur Verfügung.

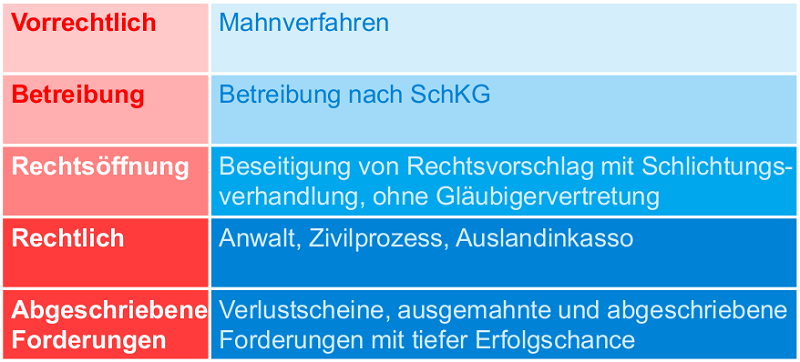

After invoicing, having sent the customer a demand for payment and a last reminder, you will try to reach the customer by phone one last time. If the payment still fails to be effected, you will then transmit the case to Creditreform and thus activate our debt collection proceedings. You will also give your consent to the next step.

We will identify your debtor unequivocally, check their solvency/creditworthiness and request them to pay. Within this context, we will act as a mediator and persuade your debtor to pay. Payment experiences are recorded in our solvency / creditworthiness database. If possible, we will agree payments by instalment and monitor the latter continuously.

You will send us complete information about each case. If your debtor effects a direct payment, we are grateful if you keep us informed so that we can close the case. If not, you will then give your consent to the next step.

We make sure that everything is duly processed within the limits of the law. Our everyday activities include petitions for debt enforcement, to continue proceedings, to sell, and bankruptcy petitions as well as communication with the authorities, the monitoring of deadlines and cost advances.

You will send us the complete documents about each case and attend the conciliation hearing. If necessary, you will effect a cost advance payment. Depending on the progress, you will then give your consent to the next step.

We are in contact with the authorities and monitor all deadlines. We request the debtor to withdraw their objection. Where it is necessary, we submit requests for setting aside objections or requests for conciliation (arbitration) in the relevant national language. If and as required, fiduciary lawyers all over the world will fight for your rights. We will make sure to file claims, manage complex court actions and conduct bankruptcy proceedings. In the process, we avoid vices of form and keep costs to a minimum. Of course, we will always keep you informed.

You will send us your certificates of shortfall and / or written-off claims. If your debtor effects a direct payment, we are grateful if you keep us informed so that we can close the case.

We will search for and unequivocally identify your debtor in order to be in a position to monitor their solvency / creditworthiness. As soon as payment by instalments is agreed or a balance agreement is entered into, we will monitor them continuously. We will always manage this process in a systematic and long-term approach and avoid unnecessary prescriptions.

Since the revised DEBA entered into force on 1 January 1997, certificates of shortfall now lapse after 20 years in Switzerland. Thus, for the first time, all certificates of shortfall issued before 1.1.1997 will lapse on 1 January 2017.

Your request for debt enforcement is contested with an objection, and all you have is a delivery note or an acknowledgement of order. As a result, you then have to decide whether to risk lengthy ordinary proceedings triggering unforeseeable lawyers’ costs, or to write off the whole claim at once.

The CrediCAP debt collection insurance is a product designed by Creditreform in cooperation with the legal expenses insurance company CAP Rechtsschutz-Versicherungsgesellschaft AG, exclusively for CrediMEMBER. This insurance covers the legal charges and lawyers’ fees following an objection.

Take out an exclusive CrediCAP debt collection insurance policy now. Commit your future claims as from the second reminder to the cost-efficient amicable debt collection of Creditreform. This will ensure from the outset that you have the best possible chances of success to possibly still settle the matter amicably. If an objection is filed nevertheless in the ensuing process and the conditions for CrediCAP are met, your Creditreform debt collection company will recommend that you should commit the dossier to the CrediCAP procedure. It will be up to you to decide whether you wish to take the insured case to court without extra costs, or whether you prefer to write it off.

Receivables not only cost nerves but also money. In order to determine by how much you will have to increase your turnover to compensate a possible loss of receivables, use our practical calculator for losses. You will see at once what the consequences of unpaid invoices are for your business.

Become a member of the largest creditors' association in Switzerland.

Become a member nowYou have received a letter from Creditreform? Here you can find out how to proceed.

Settle claim| Monday to friday: | 08:00 - 12:00 |

| Monday to friday: | 13:00 - 17:00 |

The competence of our experts always depends on the registered office of your company. If you have any questions about membership or about our products and solutions, Creditreform will be happy to assist you on site. By entering your five-digit postcode you will find your personal contact.

You will now be redirected to your club.

You will now be redirected to the overview page.